what is a levy on land

The Community Infrastructure Levy the levy is a charge which can be levied by local authorities on new development in their area. A land value tax LVT is a levy on the value of land without regard to buildings personal property and other improvements.

What Is A Tax Levy Bench Accounting

The recording at the Essex County Registry of Deeds.

. What Is a Property Tax Levy. A levy is a legal process performed by a bank or taxing authority. A levy is the legal seizure of property to satisfy a debt.

Rates taxes and levies are fees paid to the authority that services your property such as a body corporate or municipality. A Levy and Suspend involves recording the Execution on Money Judgment along with a description of the defendants real estate. The judgment creditor gets a court order authorizing a levy on your property.

Property tax is the tax liability imposed on homeowners for owning real estate. An IRS levy permits the legal seizure of your. Generally here are the steps in the levying process.

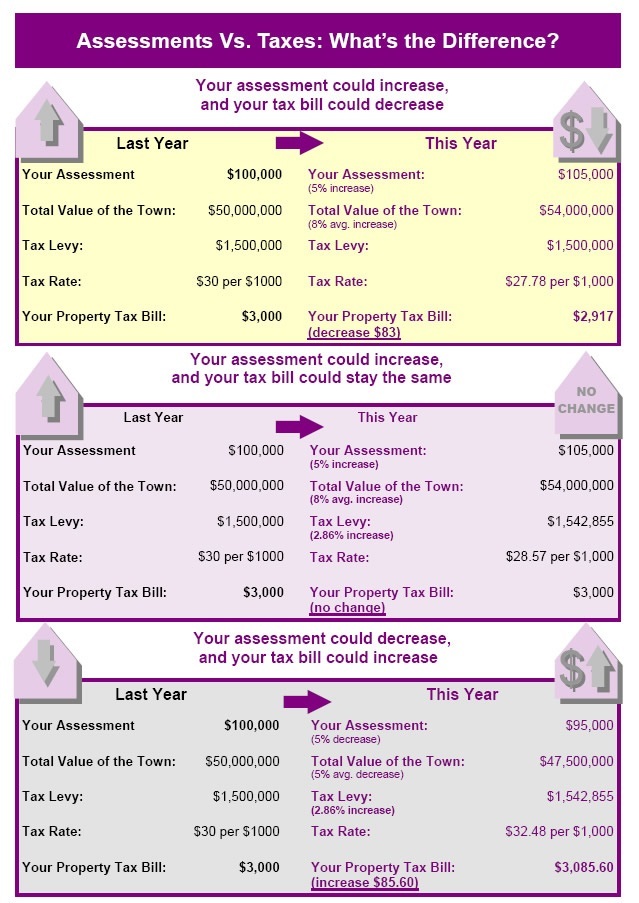

The mill levy is the total tax rate levied on your property value with. The usual mode of making levy upon real estate is to describe the land which has been seised under the execution by metes and bounds as in a deed of conveyance. Sun Oct 02 2022 003216 GMT-0700 Pacific Daylight Time.

A levy is a legal process performed by a bank or taxing authority. Written notice of levy on land a In all cases of levying on land written notice of the levy must be given. 9-13-13 - Written notice of levy on land OCGA.

The importance of paying levies. Each entity calculates its required mill levy and they are then tallied together to calculate the total mill levy. These fees are dependent on your property type and are paid to the.

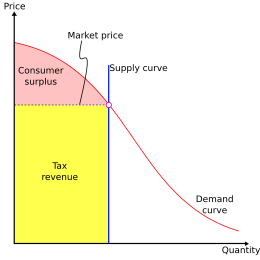

In Maryland a levy on real property is made pursuant to a. A notice of levy is a document that apprises a debtor that a judgment creditor has applied to a court for permission to attach or levy his assets or real property as a means with which to. A levy represents the total amount of funds a local unit of government may collect on a tax rate.

It is an important tool for local authorities to. A levy means the seizure or sale of specific property of a debtor to satisfy a debt or obligation owed to a creditor. Up to 25 cash back How the Levying Process Works.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The Planning Gain Supplement due to be introduced by the Government this autumn looks likely to increase the costs of housing development in the UK. It is slightly different from the lien as it is only a claim against a property to get the payment whereas in.

Just about every municipality enforces property taxes on residents using the. It can garnish wages take money in your bank or other financial account seize and sell your. Within a sectional title ownership scheme every owner is required to pay a monthly contribution to the body corporate - known as the levy.

The Environmental Mitigation Levy only applies to areas declared by the Secretary of the Department of Environment Land Water and Planning DELWP as levy. In the US the Internal Revenue Service IRS has the authority to levy an individuals property such as a car boat. A tax rate is the percentage used to determine how much a property taxpayer will pay.

In the US the Internal Revenue Service IRS has the authority to levy an individuals property such as a car.

Norfolk County Sheriff S Office Levy On Real Property

17051 Sr 121 Williston Fl 32696 Levy Jones Loopnet

Levy County Fl Land For Sale 521 Properties Landsearch

Levy Sc Land For Sale 34 Properties Landsearch

Lot 2 E Levy St Other City In The State Of Florida Fl 32696 4 Photos Mls A11240966 Movoto

Levy Group Sells Land At Northwest Place Industrial Park Ii Rednews

Property Taxes Urban Institute

Land Tax Meaning Charge Calculation Online And Offline Payment

Land For Sale Undeveloped Land For Sale In Levy County Florida Land Com

![]()

Levy County To Update Land Development Codes

Property Tax Deduction A Guide Rocket Mortgage

Levy County Florida Land For Sale Landflip

Broken Arrow Power Plant Claims County Has No Authority To Levy Property Taxes Citing Mcgirt Decision Money Cherokeephoenix Org